“Binance Effect” Newly Listed Token Price Increases Average 40%

Binance Effect Newly Listed Token Price Increases Average 40%

Analysis of Binance Listed Tokens

Crypto asset (virtual currency) investor Ren & Heinrich (hereinafter referred to as R & H) announced on the 4th the impact of listing on the major virtual currency exchange Binance on the token price. Most of the analyzed cryptocurrencies have shown significant price increases in the first few days after listing.

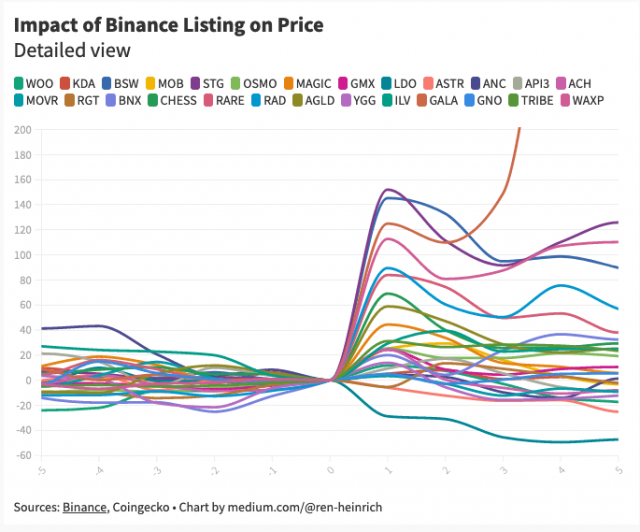

When R&H conducted a price analysis before and after the listing announcement for 26 stocks listed on Binance over the past year and a half, the following results were obtained.

Source: R&H

Graph for 5 days before and after listing

- The average price increase rate of all stocks on the first day after listing was +41%

- +24% average price performance by day 3

- On average, cryptocurrencies remained positive for 22 days after listing before turning negative again.

- The average highest price in the 30 days after listing is +73% from the listing date

Furthermore, when analyzing the listing timing of the target virtual currency by dividing it into a bull market and a bear market, the difference became clear.

For example, bull market listed stock prices averaged +49% on day 1 and +34% on day 3, while bear market listed coin prices averaged +34% and +34% respectively. 13%. After going public, the average number of days the price was above the listing price was 18 days in a bull market and 8 days in a bear market.

Based on the above analysis results, R&H summarizes as follows.

- Listing on Binance has a positive impact on cryptocurrency prices in most cases

- Strong price increases usually occur on the first day after listing

- The positive price momentum is relatively short-lived: almost half lost gains after two weeks.

- Most of the stocks with negative prices after two weeks were listed in a bear market.

- Stocks that went public during a bull market are performing better than stocks that went public during the current bear market.

Relation:What is the world’s largest virtual currency exchange, Binance?

Expect Binance Effect

In April 2021, Roberto Talamas, an analyst at Messari, a cryptocurrency data analysis company, said that new listings on the major U.S. cryptocurrency exchange Coinbase tend to lead to greater price increases than other major exchanges. pointed out that there is This has become known in the cryptocurrency market as the “Coinbase effect”.

Similar to Coinbase, the trend of rising prices, which can be called the “Binance effect,” has been observed.

According to the 2022 cryptocurrency market summary report released at the end of December by Arcane Research, a cryptocurrency data analysis company, it became clear that Binance accounts for more than 90% of Bitcoin spot trading volume. (as of December 28)

Relation:Binance Holds 90% of Bitcoin Spot Trading Volume – Arcane Research

“At a time when cryptocurrency trading liquidity is more concentrated on Binance, a listing on Binance could have a greater impact on prices,” said Talamas. He believes that making it easier for individual users to access cryptocurrencies is one of the reasons why Binance’s trading volume has risen.

Also, Grzegorz Drozdz, a market analyst at financial services firm Conotoxia, estimated that two-thirds of stocks will see higher prices after listing on Binance in 2022.

Relation:World’s Largest Cryptocurrency Exchange Binance Expands to Japan, Acquires Sakura Exchange

“Binance Effect” Newly Listed Token Price Increases Average 40% Our Bitcoin News.