Bitcoin Market Deterioration in Both Fundamental and Technical, Prospects for Lower Prices|bitbank Analyst Contribution

관련 글: Defi Market Cap Drops 25.1% in One Day: Proponents Say Tokens Self Correcting

Virtual currency market this week from 5/6 (Sat) to 5/12 (Fri)

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

- table of contents

-

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 5/6 (Sat) to 5/12 (Fri):

The Bitcoin (BTC) exchange rate against the yen this week is developing to seek a lower price from 3.9 million yen, and as of noon on the 12th, it is hovering around 3.6 million yen.

With the rise of the BRC-20 token standard, meme coins proliferated, and Bitcoin remittance fees soared over the weekend, putting a strain on the network. In response to this, Binance temporarily suspended BTC withdrawals, and in addition to the turmoil that created fork chains, the BTC market became weak from the beginning of the week, dropping to 3.7 million yen.

The tight network and soaring fees peaked at the beginning of the week, and gradually improved from the next day. BTC lost its sense of direction at the 3.7 million yen level as the yield of US Treasuries remained stable.

The US CPI rose 4.9% year-on-year, falling below the market forecast of 5%, and BTC tried to recover by 3.8 million yen, but the gold (XAU) market took a profit and the US stock price fell. When under pressure, it made a sharp pullback with a false report that there was movement in BTC seized by the US government from the Silk Road.

The US government’s BTC remittance was a false alarm, and the market stopped declining around 3.7 million yen. BTC fell below 3.7 million yen as Governor Kashkari of BTC made a statement in favor of prolonging high interest rates.

[Fig. 1: BTC vs Yen chart (1 hour)]Source: Created from bitbank.cc

BTC’s soaring remittance fee has once shown signs of peaking out, but the uncertainty surrounding the US debt ceiling issue and policy interest rate trends is weighing on the market.

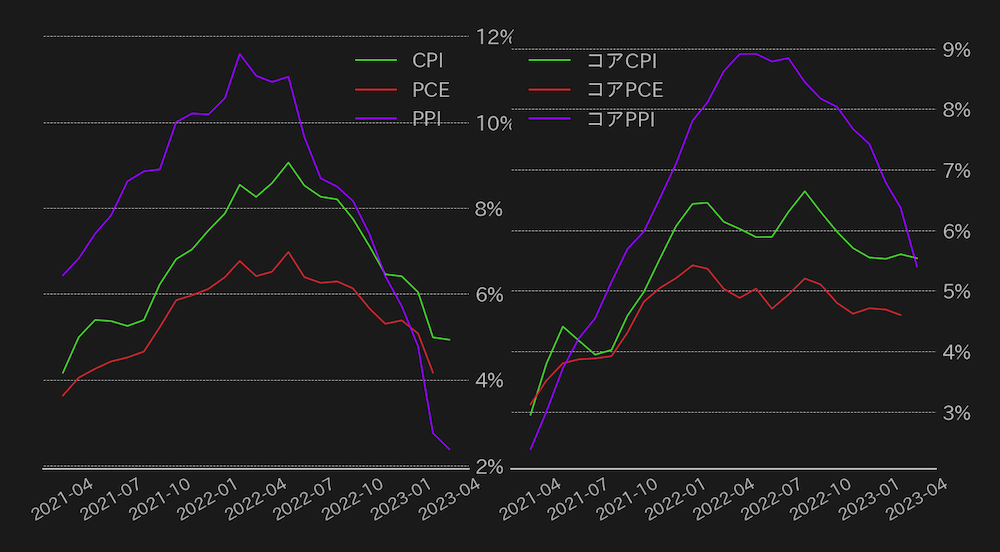

This week’s April U.S. consumer price index (CPI) and producer price index (PPI) did not beat market expectations, but the pace of the headline CPI slowdown slowed. And the core index excluding energy stayed high, and it can be said that it was a poor result as a clue for the US Federal Open Market Committee (FOMC) meeting in June.

In the federal funds futures market, it is still almost certain that the June interest rate hike will be postponed, and many expect a rate cut to begin in September. No clues are available, pointing to a possible gap between the market and the Fed’s outlook.

관련 글: 애플 비전 프로 실제 착용 모습들

[Fig. 2: US Inflation Index Year-on-Year]Source: Created from FRED

New claims for U.S. unemployment insurance hit their highest level since October 2021 this week, and while the slowdown in the labor market was a welcome addition to the market, more needs to be done to reassure a halt to rate hikes. Let’s say you need data.

BTC’s price against the US dollar hits a two-month low, and today it has already broken below the $27,000-$31,000 range, which will be the highs of the year, and below the 200-week moving average. In addition to fundamental uncertainties, it has been pointed out that technical sentiment has deteriorated more clearly, and it is realistic to see the February highs and the lower bounds of the Ichimoku Cloud on the daily chart close together at $25,300. It can be said that the price is on the verge of falling (Figure 3).

[Fig. 3: BTC vs. USD chart (daily)]Source: Created from Glassnode

connection:bitbank_markets official website

Last report:Bitcoin remains solid, May FOMC may be a headwind

Bitcoin Market Deterioration in Both Fundamental and Technical, Prospects for Lower Prices|bitbank Analyst Contribution Our Bitcoin News.

관련 글: 엄마가 목감기에 걸렸다