Bitcoin recovers to the $21,000 level with a sharp rise, Solana-related stocks soar across the board

Bitcoin recovers to the $21,000 level with a sharp rise, Solana-related stocks soar across the board

Macroeconomics and financial markets

In the US NY stock market on the 13th, the Dow closed at $113 (0.33%) higher than the previous day.

The slowdown in the US consumer price index (CPI) for six months in a row is behind expectations of a slowdown in the pace of interest rate hikes by the Fed (Federal Reserve).

Relation:Financial market tankan on the morning of the 14th | Bitcoin returns to $20,000, AI-related tokens soar

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 1.94% from the previous day to $21,166.

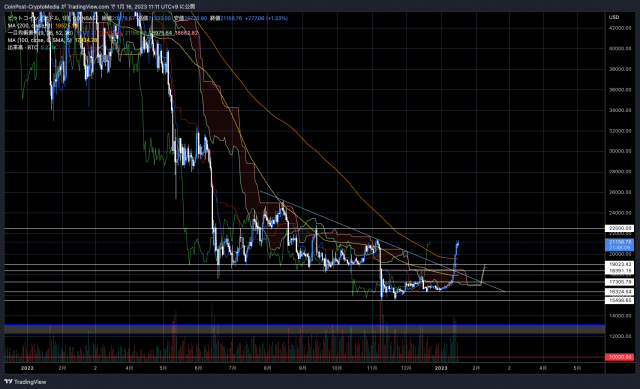

BTC/USD daily

The breakout of the $18,400 resistance line (upper resistance line) strengthened the rally, surpassing the daily 200 SMA (200-day moving average).

Ki Young Ju (@ki_young_ju), CEO of data analysis company CryptoQuant, said on the 14th that “market buying worth $4 billion” was entered in the Bitcoin futures market, and short positions worth $87 million were cut (forced liquidation). I made it clear.

For the past 3 hours, someone(s) just bought ~$4B worth of $BTC futures in market orders, and $87M short positions liquidated across all exchanges.https://t.co/JDrkUzPMqq pic.twitter.com/tOrmokB0z3

— Ki Young Ju (@ki_young_ju) January 14, 2023

Many people point out that it is too early to judge that the trend of the cryptocurrency (virtual currency) market has changed at this point, but the price has returned to the level before the collapse of FTX in November last year, and the United States after 2023 It is possible that the tide has begun to turn, with an eye to the landing and turning points of the tightening monetary policy.

The leading indicator “dollar index” is more prominent. After the end of the excessive liquidity market due to monetary easing ((1)) was suggested by the tapering, the violent dollar buying in the tightening phase of monetary policy took a break and peaked out ((2)). The trend has already changed.

DXY/USD Weekly

Fed Chairman Jerome Powell said that a pivot (policy change) to cut interest rates would not come for the foreseeable future. Past cycles have been largely the same.

Some point out that the focus has begun to shift to economic trends, as the sharp decline in the dollar index suggests the unwinding of funds to risk assets such as stocks and virtual currencies.

According to Ki Young Ju, US sentiment toward Bitcoin (market sentiment) turned from negative to positive as of the 13th.

#Bitcoin market sentiment turned positive in the US.

It was traded over +1.27% premium per minute on Coinbase as of Jan 13th, 2023 at 19:38 EST.https://t.co/XQXuT8Qszo pic.twitter.com/HDVYcoX1cf

— Ki Young Ju (@ki_young_ju) January 14, 2023

The premium index of the US largest exchange Coinbase, a favorite of institutional investors, increased by 1.27%.

Relation:This week’s bitcoin is technically bullish, such as three-way turnaround | bitbank analyst contribution

Minor situation

With the rise of Bitcoin, the miner situation is also improving.

Difficulty (mining difficulty) has increased significantly by more than 10% compared to the previous time, the largest since October last year.

btc.com

The difficulty level is adjusted once every two weeks, and the time required for mining one block is automatically adjusted to about 10 minutes according to the increase or decrease of the hash rate, which is the computing power on the network. .

U.S.-listed companies such as Marathon Digital Holdings and Hive Blockchain are intermittently purchasing state-of-the-art mining machines such as “ANTMINER S19 XP” and “BuzzMiners” equipped with Intel’s new chip. The background is intensifying competition among miners due to improved incentives.

Such a reversal of difficulty suggests that industry reorganization is progressing as the weeding out of small and weak miners with inferior business scale and efficiency amid rising energy costs.

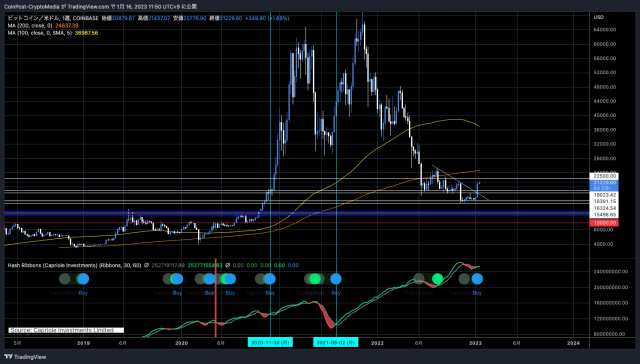

The lighting of Hash Ribbons after the miner’s surrender period also attracted investor interest.

BTC/USD Weekly

This indicator is one of the indicators for predicting the market trend by observing the “30-day moving average line” and “60-day moving average line” in the hash rate of BTC miners (diggers). In the historical market, it is recognized as a relatively reliable signal.

alt market

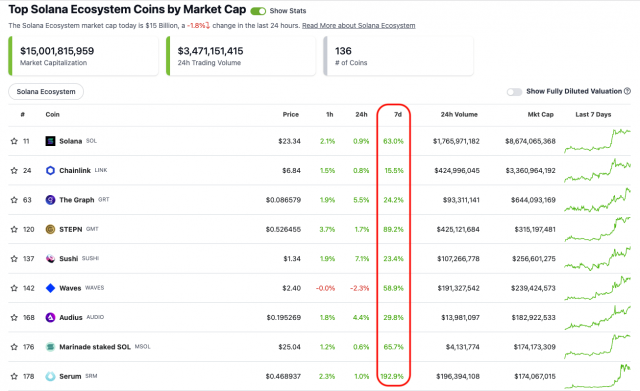

Along with the sharp rebound of Bitcoin, funds have also flowed into altcoins, and the stocks of the Solana ecosystem, such as the Solana (SOL)-based blockchain, have also risen across the board.

Coingecko

Compared to the previous week, Solana (SOL) increased by 63%, STEPN (GMT), which deploys multi-chains on SOL, BNB, and ETH, increased by 89.2%, and Serum (SRM) increased by 192% on Solana-based DEX (distributed exchange). 65.2% higher for Raydium (RAY) and 190% higher for Orca (ORCA).

In addition to speculation related to Google Cloud, which introduced Solana’s node operation agency service in November last year, and the soaring meme coin BONK airdropped at the end of last year, Alameda Research-related stocks, which went bankrupt the other day, have been funded in the futures market. The rate (funding rate) was tilted toward overselling, so it seems that the short squeeze helped.

Ethereum (ETH), which is about to undergo a “Shanghai upgrade” in March this year, also showed a solid increase of 2.17% from the previous day and 17.6% from the previous week.

Relation:What impact will the Shanghai upgrade scheduled for March have on the Ethereum market?

GM radio archive release

https://t.co/nr8dNhvmzM

— CoinPost Global (@CoinPost_Global) December 22, 2022

Special guests this time are Yat Siu, chairman of Animoka Brands, a major Web3 (decentralized web) company, and Benjamine Charbit of Darewise Entertainment. He talks about the current challenges of Web3 games and NFTs, Darewise’s first title “Life Beyond”, and the outlook for the industry.

Relation: To hold the 2nd “GM Radio”, guests are the chairman of Web3 major Animoka Brands

[Announcement]

CoinPost Hosts One of Asia’s Largest International ConferencesDate: July 25th and 26th, 2023

Venue: Tokyo International ForumPress release https://t.co/vvgzhfPOVb

[Specified]Accepting pre-whitelist registration that can be completed in 2 seconds https://t.co/bigJoFNBvh pic.twitter.com/5FfHvqKppB

— CoinPost-virtual currency information site-[app delivery](@coin_post) December 26, 2022

Click here for a list of market reports published in the past

Bitcoin recovers to the $21,000 level with a sharp rise, Solana-related stocks soar across the board Our Bitcoin News.