Bloomberg: Correlation between Bitcoin and gold reaches its highest level in 10 years

But that may not mean what you think it means.

In its latest crypto newsletter, Bloomberg said that according to its records, the correlation between Bitcoin (BTC) and gold is at its highest level since 2010:

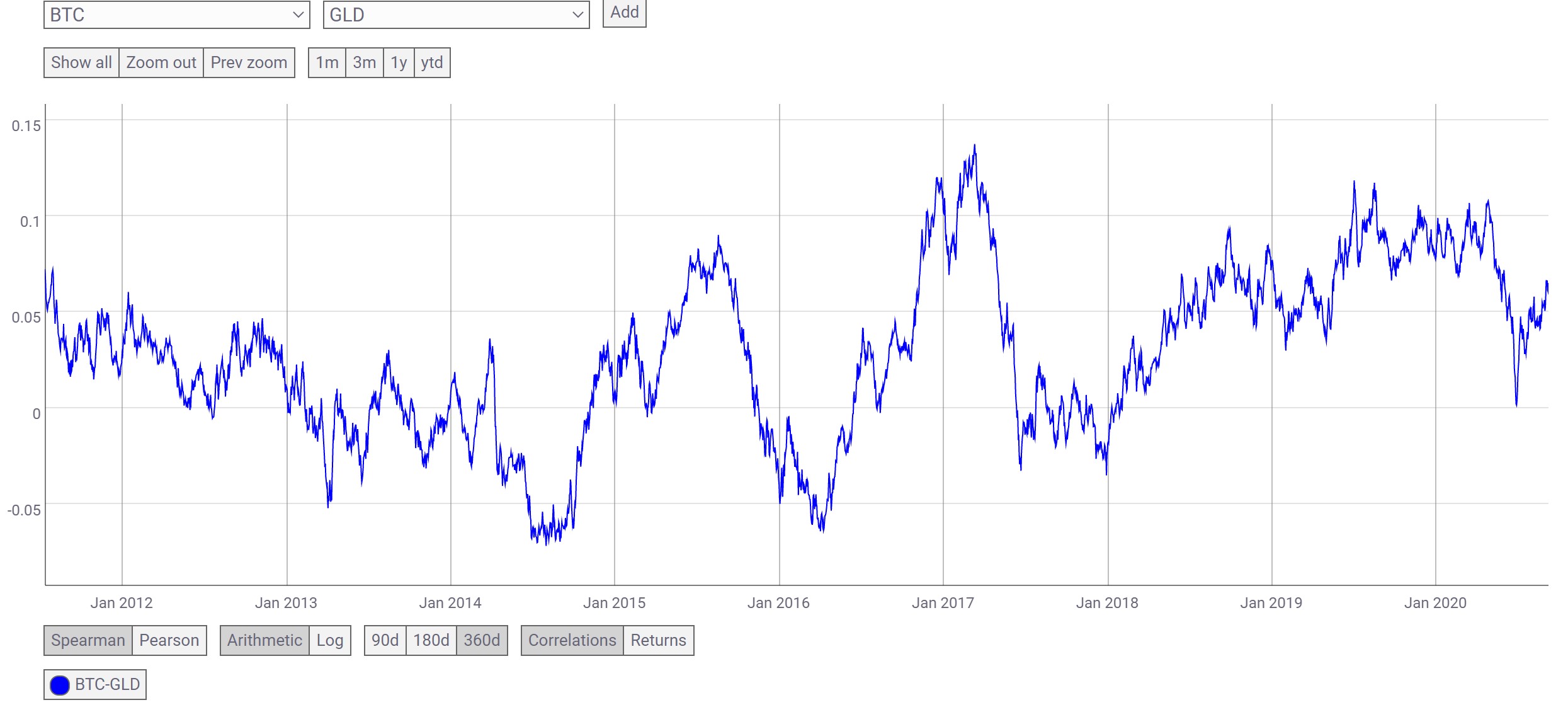

Bitcoin and gold correlation. Source: Coin Metrics.

If you look at the chart above or find other charts online that track correlations between the two assets, you will likely see something that will contradict Bloomberg’s assertion. Yet according to Bloomberg, it stands at 0.80. The caveat here, however, is that Bloomberg calculates this metric differently from many other data providers:

“On a 12-month basis, the quasi-currencies are about 0.80 correlated, the highest in our database since 2010.”

Bloomberg analyst and author of the newsletter, Mike McGlone, further explicated the firm’s calculus:

“Bloomberg default and simple % change function. The % monthly changes on a rolling 12-month basis, past 12-months, the highest in our database.”

Instead of determining the correlation daily, Bloomberg calculates the interrelation of this data on a monthly basis, hence the difference.

McGlone believes that the recent plunge in Bitcoin’s price was driven by the Nasdaq’s dip, concluding that if gold maintains the price level above $1,900, he expects Bitcoin to stay above $10,000.

The record-high correlation between the two hedge assets can likely be explained by the fact that we are experiencing unprecedented economic upheaval in Bitcoin’s short history. The injection of trillions of fiat currencies into the global economy may be prompting investors to seek shelter in alternative assets.