Change in stablecoin power map While BUSD dominance is declining, USDT is over 50% again

Change in stablecoin power map While BUSD dominance is declining, USDT is over 50% again

Potential lawsuit over BUSD issue

The U.S. Securities and Exchange Commission (SEC) claims that the US dollar-linked stablecoin “Binance USD (BUSD)” is a security, and its issuer Paxos has failed to register the security with the SEC. (Wells Notice)”.

Paxos announced on the 13th that it had received the notice 10 days earlier (February 3). He made it clear that he did not agree with the SEC’s decision.

Paxos categorically challenges SEC officials because BUSD is not a security under the federal securities laws. We are prepared to discuss this matter with SEC staff and take it to court vigorously if necessary.

A Wells notice is an official document that officially states that the SEC intends to take legal action against a company or individual on notice. Enforcement, however, requires a vote of five SEC commissioners and may not necessarily result in litigation, he said.

Paxos was ordered by the New York State Department of Financial Services (NYDFS) to stop issuing new BUSD on the 13th. The company announced that it will stop issuing new BUSD on the 21st of this month and will also end its relationship with Binance over BUSD. On the other hand, we will continue to provide BUSD management and redemption services, giving top priority to the safety of customer assets.

connection:New York authorities order Paxos to stop issuing new stablecoin BUSD

Paxos’ unaudited BUSD holdings report shows $16.4 billion in dollar-denominated reserves in excess of $16.14 billion in pre-maturity BUSD, of which $12.5 billion is held in U.S. Treasury Department “Reverse Repurchase Agreements (RRPs)” It is

RRP is to borrow funds using bonds as collateral. U.S. Treasury bills maturing in April 2023 are worth $3.1 billion.

The Paxos Proof of Assets Report is issued by the independent accounting firm “WithumSmith+Brown, PC (Withum)” and discloses its portfolio composition five business days after the end of each month.

The New York State Department of Digital Financial Services, which oversees Paxos, stipulates that stablecoin reserves corresponding to redemptions must be segregated and held equal to or greater than the value of all issued stablecoins.

Paxos disclosed a breakdown of its reserve assets in 2021, with about 96% being cash and cash equivalents and the remaining 4% being government-issued “U.S. Treasury Bills” with maturities of up to one year.

Problems with BUSD

BUSD is a stablecoin named after Binance, a major crypto asset (virtual currency) exchange. It was jointly developed by Binance and Paxos in 2019 and is issued, stored and managed by Paxos under the authorization and supervision of NYDFS.

NYDFS pointed out that there are several unresolved issues in the relationship between Paxos and Binance as the reason for ordering the suspension of BUSD. He explained as follows.

- Authorization to issue BUSD granted to Paxos

- Authorization for issuance on the Ethereum (ETH) blockchain

- We do not authorize BUSD issued on other blockchains

connection:New York State Department of Financial Services Explains Why It Ordered the Suspension of Issuance of the BUSD Stablecoin

According to Binance’s official website, Binance provides the issuing service for BUSD (Binance-Peg BUSD = BP BUSD) provided on blockchains other than ETH. Binance locks BUSD on ETH issued by Paxos and issues the same amount of BP BUSD on other blockchain networks.

Regulators may see this as a problem.

According to data from blockchain analytics firm ChainArgos, Binance-peg BUSD frequently undercollateralized between 2020 and 2021, Bloomberg said. At one point, the gap between Binance’s BUSD reserves and BP BUSD supply exceeded ¥130 billion ($1 billion).

Binance has acknowledged some troubles in the past regarding the maintenance of BP BUSD reserves, and has announced that it has strengthened checks and improved the process to ensure that BP BUSD is collateralized 1:1 with BUSD. .

Is BUSD a security?

Since the demise of FTX, the SEC has tightened its regulatory leash on cryptocurrencies, and the industry is watching closely to see if stablecoins are the next target.

Meanwhile, some people point out that it is difficult to define BUSD as a security in light of the Howey test, which is the standard for judging securities. Securities that satisfy all of the following four elements are considered securities.

- money investment

- is a joint venture

- have a reasonable expectation of profit

- benefit from the efforts of others

BUSD is a stablecoin, it is not intended to make a profit just by holding it, and Paxos does not offer BUSD yield products.

U.S. Senator Pat Toomey, a well-known cryptocurrency advocate, asked SEC Chairman Gary Gensler during a 2021 public hearing to explain that stablecoins did not meet the Howietest standards.

Stablecoins do not meet the Howey Test. Senator Pat Toomey challenges Gary Gensler on 14 Sept 2021 (Full Version) #BUSD #Binance pic.twitter.com/Iyh5uTqcfi

—CryptoAlerts365 (@CryptoAlerts365) February 13, 2023

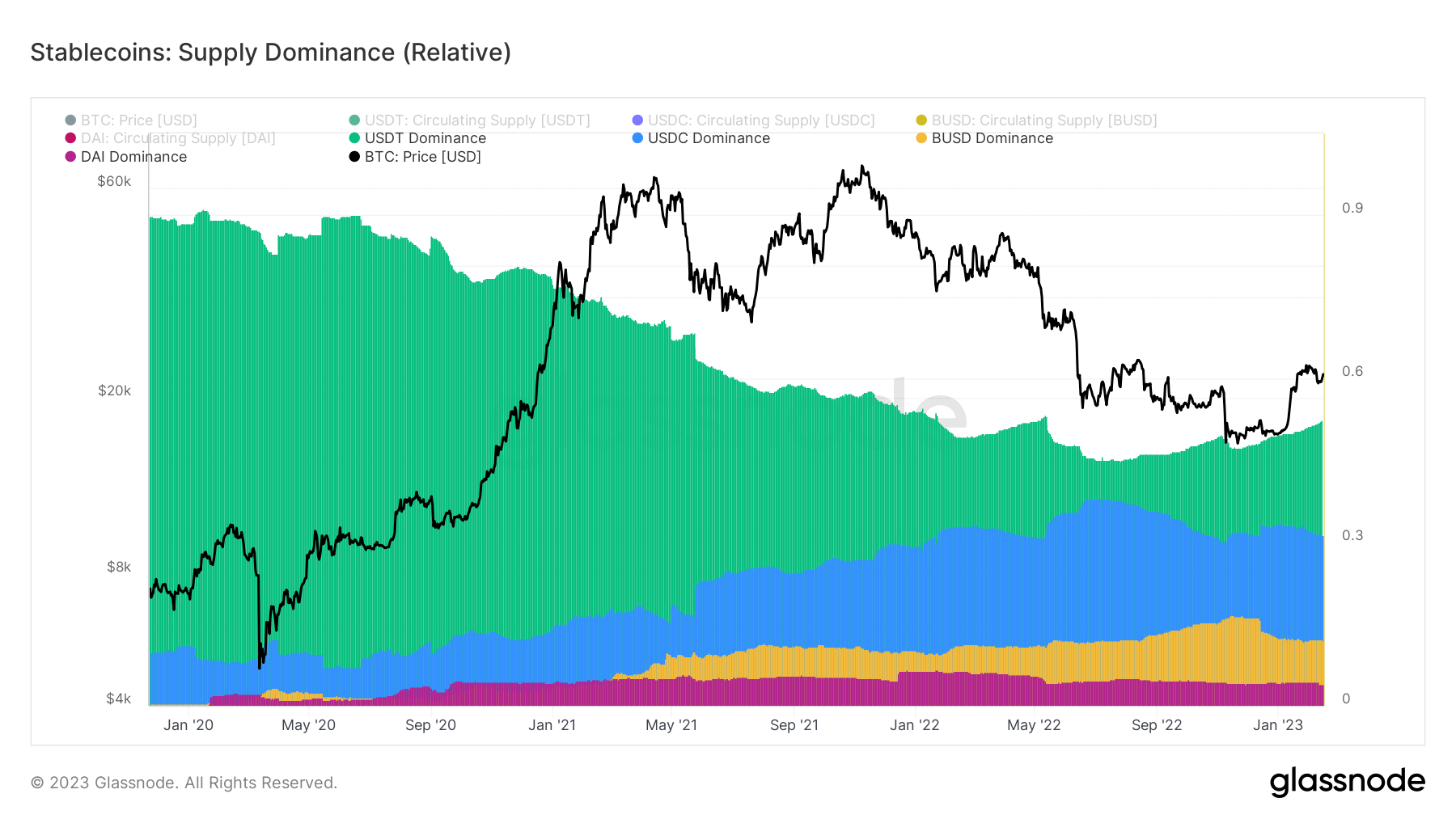

In response to the situation surrounding Paxos and BUSD, there is also a change in the power map of stablecoins, which are used as key currency pairs on major cryptocurrency exchanges.

Glassnode data shows BUSD dominance dropping to 12% from 17% in Nov 2022, while Tether (USDT) dominance increased. It surpassed the 52% level for the first time since May 2010. USDC, the second largest in the industry, maintains about 30%.

Stablecoin dominance (coinglass)

Change in stablecoin power map While BUSD dominance is declining, USDT is over 50% again Our Bitcoin News.