Bank of Japan monetary policy meeting, “yen depreciation, dollar strength” sharp rise due to continued easing Nikkei Stock Average and yen-denominated Bitcoin rise

Bank of Japan monetary policy meeting

Monetary easing policy maintained

The Bank of Japan decided to maintain its large-scale monetary easing measures at its monetary policy meeting held on the 17th and 18th.

It seems that they have unanimously decided to maintain the current level of about 0.5% as the upper limit for long-term interest rates (the upper limit for guiding 10-year interest rates). The YCC (Yield Curve Control) policy framework will continue.

Going forward, the appointment of a new governor to succeed Kuroda at the Bank of Japan could have a major impact on the market.

In the midst of rising pressure on interest rates due to concerns about the risk of revisions to the easing that continued in December last year, the yen weakened and the dollar strengthened significantly immediately after the announcement in the foreign exchange market (FX).

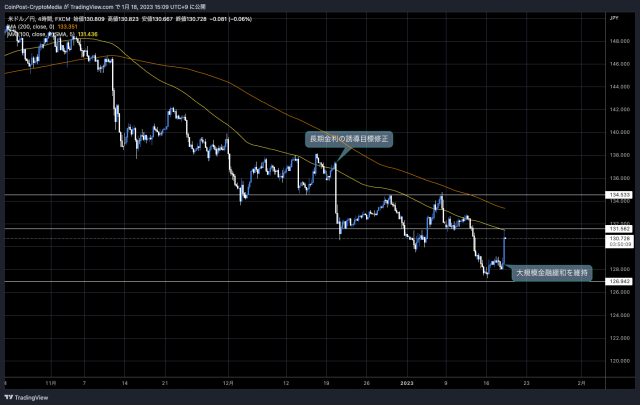

The dollar/yen exchange rate fell sharply from the mid-128 yen level to the 131 yen level to the dollar, the lowest level in a week.

dollar yen 4 hours

The view that the dollar, which is advantageous in terms of investment, is bought and the interest rate differential between Japan and the United States will widen again has emerged again.

Relation:The background of the “strong dollar” that affects the virtual currency market also explains the correlation and the factor of the weak yen

Nikkei average rebound

Following the Bank of Japan’s policy announcement before noon, the Nikkei Stock Average rebounded sharply in the afternoon. It was 652 yen (2.50%) higher than the previous day. It rose nearly 500 yen from the previous day’s 163 yen appreciation at the close of the previous session.

Automobile-related stocks, which are exported, were bought on the speculation of a weaker yen.

Relation:Recommended securities account ranking for the stock market that can be used at a great price

Bitcoin (BTC) and Ethereum (ETH), etc. rose in yen due to the rapid depreciation of the yen and the appreciation of the dollar.

Bank of Japan monetary policy meeting, “yen depreciation, dollar strength” sharp rise due to continued easing Nikkei Stock Average and yen-denominated Bitcoin rise Our Bitcoin News.