Bitcoin futures market to buy and hold, pay attention to price movements after index announcement | bitbank analyst contribution

Bitcoin futures market to buy and hold, pay attention to price movements after index announcement | bitbank analyst contribution

Virtual currency market this week (12/31 (Sat) – 1/6 (Fri))

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

- table of contents

-

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 12/31 (Sat) to 1/6 (Fri):

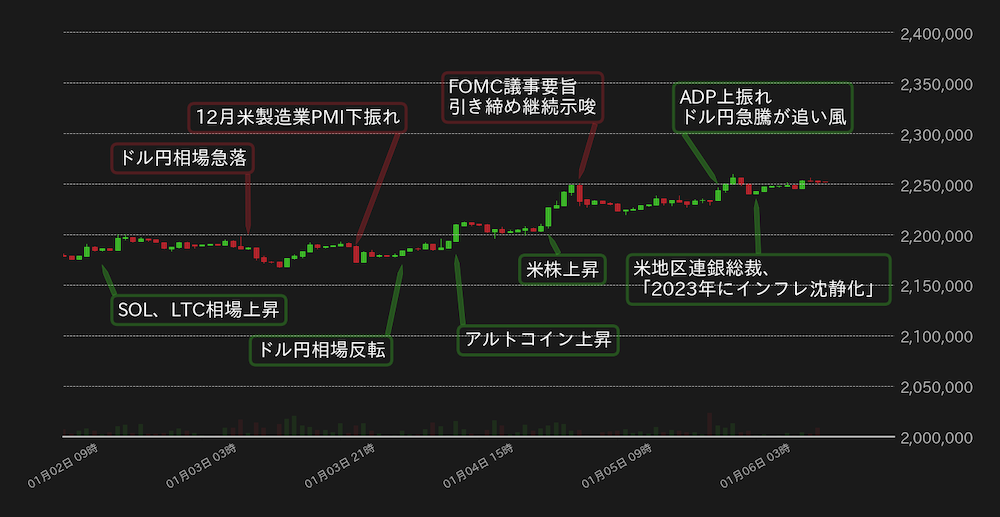

This week’s bitcoin (BTC) against the yen rose, and touched 2.26 million yen for the first time in 20 days last month. As of noon on the 6th, it is trending around 2.25 million yen.

At the beginning of the year, the BTC-yen exchange rate fluctuated slightly, but was supported by the rise in altcoin exchange rates such as Solana (SOL) and Litecoin (LTC), and recovered to 2.2 million yen on the 4th. I touched 2.25 million yen.

On the other hand, the minutes of the US Federal Open Market Committee (FOMC) meeting held in December, which was released in the early hours of the 5th, indicated that the meeting participants were strongly concerned about inflation and indicated the possibility of continuing interest rate hikes and maintaining high interest rates for a long period of time. BTC market has fallen.

After that, the BTC/USD pair continued to struggle around $16,800, but as the dollar-yen exchange rate rose in the foreign exchange market, the yen-denominated BTC exchange rate rose sharply.

According to the National Employment Report released by the ADP on the 5th, the number of private sector employees increased by 235,000, significantly exceeding the market forecast of 150,000. By doing so, BTC vs. yen is one touch to 2.26 million yen. At the feet, it is rubbing around 2.25 million yen.

[Fig. 1: BTC vs Yen chart (1 hour)]Source: Created from bitbank.cc

As volatility has declined, BTC vs. the yen has become more likely to benefit from the yen’s depreciation, but if today’s (6th) U.S. employment statistics are bullish, the BTC vs. US dollar exchange rate will drop and prices will rise. It is pointed out that weighting .

Although the recent ADP report cannot be said to be highly accurate as a leading indicator of the employment statistics, given that the number of new applications for unemployment insurance has been declining since around November, employment statistics for December Is it not possible to expect a significant slowdown in the pace of increase in the number of foreign workers?

If the results are weak, the BTC market will recover by $17,000, but with concerns about a recession simmering, the situation is likely to continue to be difficult to predict.

Since the end of the year, the funding rate of BTC futures has remained in positive territory, suggesting that the market is biased towards buy-and-hold. If the market falls in such a situation, it is possible to widen the low price with a long throw, so be careful.

However, the US consumer price index (CPI) for December is scheduled to be announced next week, and if a significant decline is confirmed as in October and November, it will support the BTC market.

Relation:bitbank_markets official website

Last report:Bitcoin on the verge of recovery, FOMC meeting minutes at the beginning of the year

Bitcoin futures market to buy and hold, pay attention to price movements after index announcement | bitbank analyst contribution Our Bitcoin News.