Blur closes in on OpenSea

In Ethereum’s NFT (non-fungible token) economy, the market share of Blur, which is characterized as an NFT marketplace for professional traders, is growing rapidly.

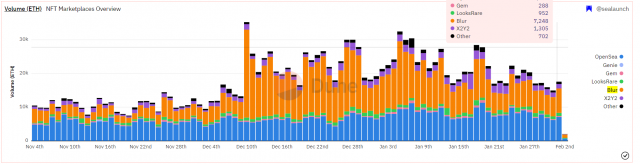

Blur, which just launched in October 2022, wins over traders with its zero fees and fast aggregation model. It is becoming comparable to the market share of the industry’s largest provider, OpenSea. According to data site DUNE, Blur’s trading volume was 7,248 ETH (1,559 million yen) as of February 1, surpassing OpenSea’s 7,077 ETH.

Source: Dune

Since its first airdrop in October, Blur has promised to intermittently airdrop its own token, BLUR, to users.

With Blur, the more NFTs you list, the more BLUR tokens you get. In addition, listing on other NFT electronic marketplaces via Blur is one of the motivations for increasing user usage, such as obtaining scores that lead to rewards.

$BLUR is launching February 14

We know this is past our initial estimate of January and we’re sorry for the delay. We’re trying new things and the extra two weeks will allow us to deliver a launch that hasn’t been done before. Airdrop 3 will continue until then. pic.twitter.com/ZzSyGzjZJD

— Blur (@blur_io) January 19, 2023

Blur was scheduled to launch its token in January, but has postponed it by a month due to the development of new features, and is slated to launch on February 14th.

Relation:OpenSea to review fee system for NFT creators

Credit to Blur

Blur was founded by anonymous activist PacmanBlur (@PacmanBlur). According to his blog post on Oct. 20, the company has raised more than ¥1.8 billion ($14 million) from industry-leading investors and individuals, including Paradigm and Cozomo Medici.

Built by a team of veterans from major companies like MIT, Square, Y combinator and Citadel, Blur’s development strategy sets it apart from other aggregators.

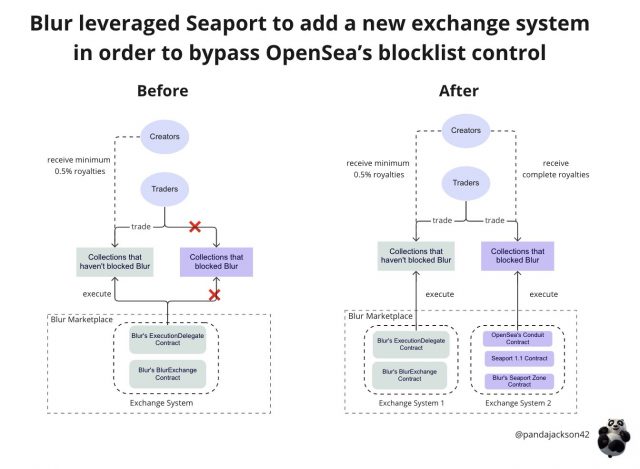

Blue, like LooksRare and SudoSwap, was blacklisted by OpenSea because it does not enforce creator fees (royalty fees). In other words, it was unable to handle NFTs issued by OpenSea’s Operator Filter Registry (OFR), which enforces royalties.

Source: Pandajackson42

However, Blur succeeded in bypassing the block list by rebuilding the service with OpenSea’s NFT trading protocol ‘OpenSea Seaport’. In addition to OpenSea’s OFR-based NFTs, Yuga labs’ Sewer Pass NFTs can also be handled.

The floor for Sewer Passes is on Blur! pic.twitter.com/CwLsn0qGbw

— Blur (@blur_io) February 1, 2023

Yuga labs developed their own blacklist tool similar to OpenSea’s OFR. Sewer Pass is an NFT distributed to collection holders such as Bored Ape Yacht Club (BAYC), and has a history of banning transactions on electronic markets Blur, LooksRare, and NFTX that do not collect creator fees.

Yuga scored a win for the entire ecosystem today, especially the creators that don’t have as big of a voice.@blur_io and @LooksRare are being forced to watch thousands of ETH in @BoredApeYC Sewer Pass volume that they are blocked from.

—nix.eth (Justin Kalland) (@nix_eth) January 18, 2023

PandaJackson, a pseudonymous analyst, points out that Blur’s efforts to integrate Seaport Protocol and increase handling of NFTs are “beneficial for creators, too.” Gaining exposure to NFT aggregators has the advantage of increasing royalty revenues from the large trading volumes generated there. He stressed that “Blur’s move could attract more creators to the space.”

Relation:NFT electronics market giant OpenSea to transition to ‘Seaport’

Can OpenSea’s stronghold be destroyed?What is the strategy of the NFT market “Blur” for professional traders? Our Bitcoin News.