Declining demand for Binance USD, stablecoin competition entering a new phase ─ Will it be a killer use case for crypto assets | coindesk JAPAN | Coindesk Japan

관련 글: ‘이건 차별 아니냐’ 가장 엄격하게 코로나 대응한 나라에서 벌어진 일

Declining demand for Binance USD, stablecoin competition entering a new phase ─ Will it be a killer use case for crypto assets | coindesk JAPAN | Coindesk Japan

Binance, the world’s largest cryptocurrency exchange, made a big push last year for its own stablecoin, Binance USD (BUSD).

However, recent speculation over the health of Binance has seen growth slow as $5.5 billion worth of BUSD was liquidated in a single month. Coinciding with the drop in demand for BUSD, data also surfaced in December showing the outflow of crypto assets deposited on Binance.

According to data from CoinGecko, the market capitalization of BUSD, which is the number of BUSD in circulation x price (theoretically $1), reached $16.4 billion (approximately ¥2.196 trillion) on January 3rd for the first time in 11 months. to the low level of At the beginning of December, it was $22.1 billion (about 2.959 trillion yen). By market capitalization, it remains the third largest stablecoin.

BUSD is issued by Paxos Trust Company, a New York-based financial technology firm, and will be pegged at $1, backed by cash reserves and Treasuries. . Similar to competing stablecoins such as Tether’s USDT and Circle’s USDC, BUSD’s purpose is to replace traditional fiat currencies with digital assets to facilitate transactions.

Challenge to Top 2

Binance will stop supporting competing stablecoins in September 2022 and automatically convert deposited stablecoins to BUSD, resulting in increased circulation offset by recent declines in circulation. rice field.

Binance officials said at the time that the effort was aimed at aggregating trading pairs on the platform. However, some analysts believe the move was to push BUSD as a challenger to the top two market caps USDT and USDC.

Binance’s strategy boosted BUSD’s market cap to $23 billion in November. By the way, in August, before the automatic conversion to BUSD began, the market capitalization was $ 18 billion (about 2.41 trillion yen).

But last month, a report on reserve assets by auditing firm Mazars undermined confidence in Binance’s stability, prompting a flurry of withdrawals from users. In particular, at the time, the industry was in a state of uncertainty following the FTX bankruptcy in November. Since then, Mazars has suspended all transactions with crypto-related clients and removed Binance’s Proof of Reserve (PoR) from its website.

“Binance’s automatic conversion to BUSD was a double-edged sword,” said Tom Wan, an analyst at 21.co, a digital asset investment product.

관련 글: Economic Blow Of The Coronavirus Hits America’s Already Stressed Farmers

Binance users withdraw their assets in USDT and USDC, so Binance had to replace BUSD with rival stablecoins to prepare for withdrawals, Wang said.

stablecoin competition

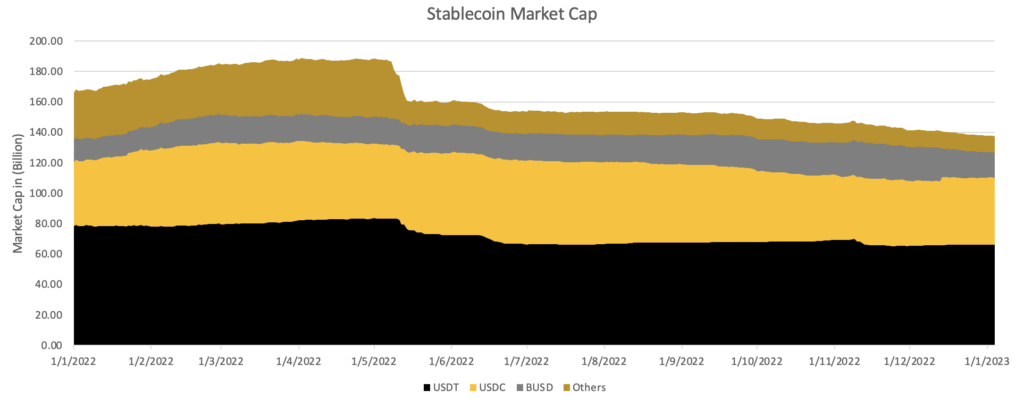

USDT and USDC’s market share increased while BUSD’s market cap fell by $6 billion. According to CoinGecko data, USDT’s market capitalization increased by about $800 million to $66.3 billion, while USDC’s market capitalization increased to $1 billion. yen) to 65.5 billion dollars (about 8.798 trillion yen).

Still, for the full year 2022, BUSD expanded more than USDT in terms of share.

According to CoinGecko data, BUSD market cap will increase by 20% in 2022. On the other hand, USDC increased by 4% and USDT market cap decreased by 15%. In addition, MakerDAO’s stablecoin DAI’s market cap fell 43%, while FRAX’s market cap also fell 44%. And of course, Terra’s stablecoin, UST, has suffered the most.

“The stablecoin race has just started between BUSD, USDT and USDC on centralized exchanges. Key indicators include Lebanon and Venezuela, who need US dollars because their currencies are depreciating. It’s demand from people.” (Mr. Wang)

Killer Use Cases for Crypto Assets

Conor Ryder, an analyst at crypto-research firm Kaiko, said the spread of stablecoins in developing countries, which often suffer from depreciating fiat currencies, could be a “killer use case for crypto.” indicate.

“Stablecoins are probably the best example of product market fit in crypto assets.

The market capitalization of all crypto assets, which once stood at $3 trillion, has shrunk to $840 billion, but the stablecoin market has held up relatively well. has only shrunk from $188 billion (approximately ¥25 trillion) to $138 billion (approximately ¥18 trillion).

This suggests that fiat-backed stablecoins are seen by many traders as a safe haven during bear markets.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

| Image: Danny Nelson/CoinDesk

|Original: Declining Demand for Binance’s BUSD Represents New Chapter in Stablecoin Wars

Declining demand for Binance USD, stablecoin competition entering a new phase ─ Will it be a killer use case for crypto assets | coindesk JAPAN | Coindesk Japan Our Bitcoin News.

관련 글: 여아래쉬가드 특가