Increased opportunities for sandwich attacks

While trading bots trying to front-run manipulate cryptocurrency (virtual currency) trading and gain huge profits, it is also reported that it is also a factor in the soaring transaction fees (gas fees) of Ethereum (ETH). there is

The bot is tied to the Ethereum Name Service (ENS) domain “jaredfromsubway.eth” and is said to feature transactions primarily targeting the emerging memecoin, PEPE Memecoin (PEPE), which has attracted a lot of attention.

The Jared bot’s activity became prominent at the same time as the meme coin boom. In one week from April 17, 2023, the Jared bot generated a profit of 360 million yen ($2.7 million). During the same period, more than 60% of Ethereum blocks were made up of transactions originating from the bot.

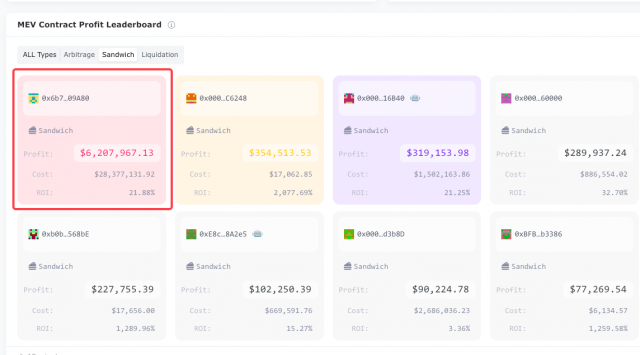

According to DeFi data platform EigenPhi, between the start of operations on February 27, 2023 and May 8, the Jared bot spent ¥4.6 billion ($34.35 million) instead of paying ¥5.4 billion ($40.65 million) in gas bills. US dollars), and made a net profit of 840 million yen ($6.3 million). During this time, the bot made 254,000 transactions, 98.31% of which were identified as sandwich attacks.

A “sandwich attack” is a kind of front-running technique in decentralized exchanges (DEXs), where you place your own large buy orders in front of other users’ orders, sandwiching them with sell orders to make a profit.

Specifically, the attacker takes advantage of the pending state in the mempool (a pool of unconfirmed transactions). Issue your own deals with higher gas prices before your target deals to ensure priority processing. As a result, attackers profit by buying tokens at a lower price and subsequently selling them at a higher price.

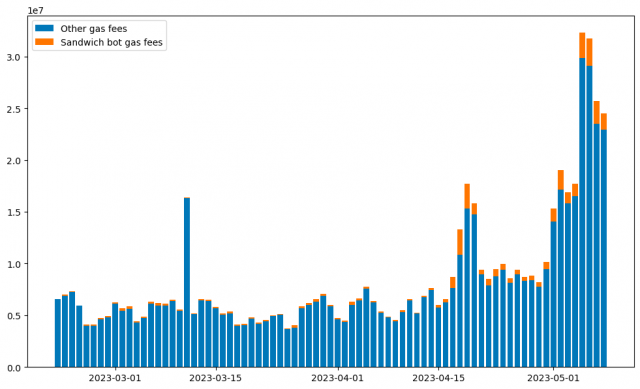

As a result, Ethereum gas prices rose to the highest level since May 2022 in early May 2023. Average transaction costs rose from an October low of 9.07 gwei to a May 5 high of 155.8 gwei and now average 55 gwei. The gas bill paid by this bot accounts for a certain percentage of the total amount of gas used in the blockchain.

Source: Eigenphi

connection:OpenSea Pro Supports PEPE Memecoin, Expanding Memecoin Ecosystem

Measures against MEV

Also, in order to maximize the opportunity for sandwich attacks, the Jared bot has been found to hold a large number of different tokens compared to other competing MEV bots. The Jared bot is said to have held over 800 tokens at its peak.

Source: Eigenphi

The return from manipulating the order of transactions on the blockchain, like a sandwich attack, is called the “Maximum Extractable Value” (MEV).

According to MEV Blocker, a sandwich attack countermeasure solution, MEV-related bots have earned over 186 billion yen ($13.8 billion) on Ethereum so far.

CoW Swap, in collaboration with @beaverbuild and Agnostic Relayer, is proud to announce MEV Blocker. https://t.co/WIhaaGtP0e

MEV Blocker is a free RPC endpoint that *pays users* to protect themselves from MEV across a wide variety of use cases in DeFi, NFTs, and dApps. pic.twitter.com/Fa6cRNjrxf

— CoW Swap | Better than the best prices (@CoWSwap) April 5, 2023

MEV Blocker is a product developed by CoW Swap, a decentralized trading protocol, in collaboration with Agnostic Relayer, which provides a decentralized relay for validators. Designed to protect users from sandwich attacks, it processes transactions through a network of users who seek out MEV opportunities called searchers.

connection:Staking provider Figment to return Ethereum MEV revenues to users

Ethereum transaction fees skyrocket, revealing involvement of Front-Rumbot Our Bitcoin News.