How to view the US SEC’s Kraken indictment and consider the impact on Ethereum staking

Will the SEC extend to staking regulations?

The staking service provided by US crypto asset (virtual currency) exchange Kraken was indicted on the 9th by the SEC (US Securities and Exchange Commission) as unregistered securities.

Discussions have developed as to whether this case is limited to Kraken’s services, or whether it also affects the staking services of US companies and the protocols themselves that employ staking.

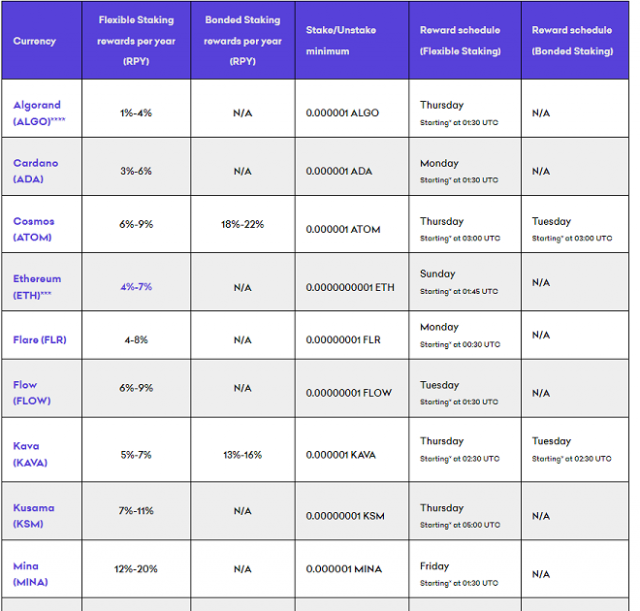

One of the things Kraken was exposed for was its lack of disclosure about the source of its pay, while claiming payouts of up to 21% per annum.

Source: Kraken

As attorney Gabriel Sapiro pointed out, Kraken staking is essentially a yield product offering, unlike other US exchanges such as Coinbase or the decentralized protocol Lido staking brokerage services. Thing.

UPDATE: a lot of my caveats come into play with this paragraph–the offer of a specific return, and Kraken not paying the actual network return out…this does make a big difference legally I think, and I can more see why kraken didn’ t litigate now pic.twitter.com/uab93cjNXp

— _gabriel Shapir0 (@lex_node) February 9, 2023

Coinbase Chief Legal Officer Paul Grewal explained that the reward rate paid to staking users reflects the protocol data as it is, and the exchange discloses the fees. But investors appear worried about a chain of crackdowns, and the company’s shares fell 14% on Monday.

Well, now we know the rumors @brian_armstrong referenced yesterday were true: @SECGov has settled claims against Kraken for particular “staking” products. https://t.co/QHgodkj2v1

— paulgrewal.eth (@iampaulgrewal) February 9, 2023

connection:US SEC: Kraken 1 cryptocurrency staking service violates securities laws

SEC opinion

If Kraken’s service is only judged to be a security, the “rumor that the SEC will ban all staking for retail investors” that Coinbase CEO Brian Armstrong feared would be groundless.

connection:US Coinbase CEO: If staking ban rumors are true, US is on a stupid path

But an SEC official told a press conference after the Kraken settlement was announced that “don’t read too much into it” when it comes to allegations of unclear compensation sources.

Kraken agreed to pay about 3.9 billion yen ($30 million), including fines and illegal gains, and to suspend staking services in the United States, but SEC officials say the Kraken case will be separated from staking as a whole. “I can’t comment on whether it’s a problem,” he said.

SEC Chairman Gary Gensler also said in a press release that he intends to crack down on crypto intermediary investment contracts.

Virtual currency intermediaries, whether through staking services, lending, or other means, must provide appropriate disclosures and protections required by securities laws when offering investment contracts in exchange for investors’ tokens. There is

SEC Commissioner Hester Perth, known as a cryptocurrency advocate, issued a statement against the SEC’s enforcement action against the Kraken. He criticized the SEC’s lack of pre-emptive guidance on staking, saying it would not be fair practice to inform regulations with enforcement action.

More transparency in crypto staking programs like Kraken could be a good thing. However, it is less clear whether a unified regulatory solution is needed, and whether that regulatory solution is best provided in the form of enforcement action by anti-cryptocurrency regulators.

Impact on Ethereum

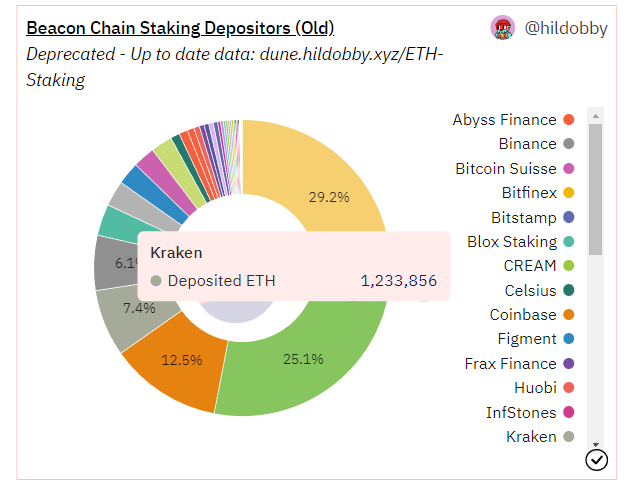

Kraken is the third largest single staking service provider for Ethereum (ETH). Cryptocurrencies other than Ethereum were unstaked on February 9 due to SEC enforcement action, and Ethereum will be unstaked after the Shanghai upgrade scheduled for March 2023.

Source: DUNE

The move is seen as a positive move for decentralized protocols like Lido (LDO) and Rocket Pool (RPT), which provide Ethereum staking services, with related tokens soaring more than 10% from the previous day. It is generally believed that these services are likely to fall short of U.S. regulations.

Positive narrative spin for later: banning US exchanges/custodians from offering staking services pushes staking offchain or abroad => ETH is no longer centralized and under the grasp of US regulators.

Decentralized ETH is better ETH.

— Alex Krüger (@krugermacro) February 9, 2023

Also, among cryptocurrency experts, there is an opinion that the direction of SEC banning staking services is positive for Ethereum. The purpose is to contribute to the soundness of the Ethereum network, just as the global decentralization of bitcoin miners has accelerated due to China’s virtual currency regulations.

On the other hand, Mr. Armstrong pointed out that letting these seeds of technological development escape the United States poses a national security risk. Explaining the importance of staking in the cryptocurrency market, he stressed, “We need to allow new technologies to grow in the US and not be hampered by a lack of clear rules.”

connection:Bitcoin investment trust GBTC’s “negative divergence”, the background of the rebound

What is staking

Staking is a mechanism in which rewards are obtained by depositing a certain amount of crypto assets (virtual currency) for a predetermined period of time.

Cryptocurrency Glossary

Cryptocurrency Glossary

How to view the US SEC’s Kraken indictment and consider the impact on Ethereum staking Our Bitcoin News.