This week’s bitcoin is technically bullish, such as three-way turnaround | bitbank analyst contribution

Virtual currency market this week (1/7 (Sat) – 1/13 (Fri))

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

- table of contents

-

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 1/7 (Sat) to 1/13 (Fri):

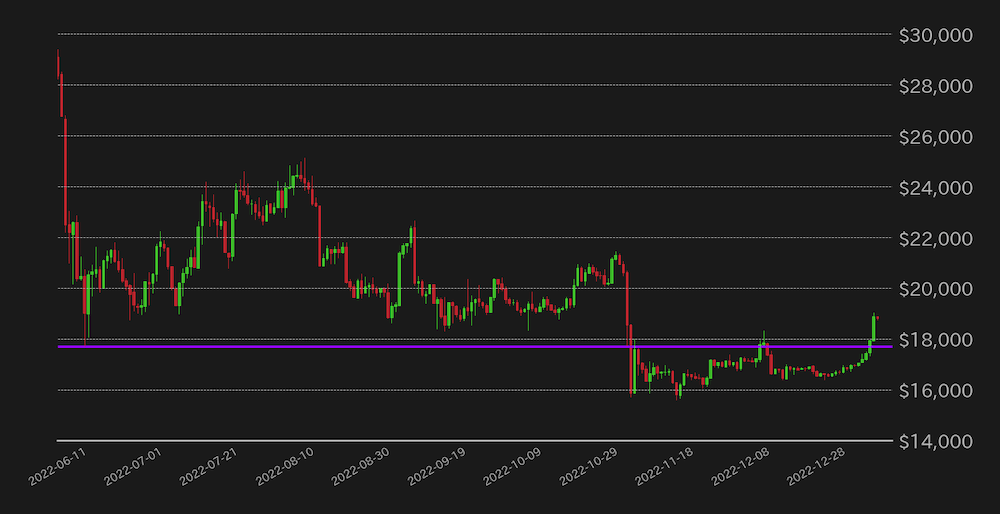

This week’s Bitcoin (BTC) vs. Yen exchange rate is certain. The dollar-denominated exchange rate recovered from last June’s low, which was cut off by the FTX shock, and briefly touched $19,000 (Fig. 1).

[Fig. 1: BTC vs. USD chart (daily)]Source: Created from bitbank.cc

BTC started the week with an uptick in risk appetite as wage growth slowed in the US jobs report on the 6th. It stalled before 10,000 yen.

On the other hand, chairman Powell’s avoidance of specifics on monetary policy gave rise to a sense of reassurance, and the World Bank (WB) lowered its 2023 global growth forecast, prompting central bank policies to slow down. Expectations for an easing of the tightening pace surfaced, and the BTC market recovered to 2.3 million yen on the 10th (US time).

After that, with the release of the US Consumer Price Index (CPI) in December, expectations of a slowdown in inflation will support the market, and the rise of some altcoins will also be a tailwind, and BTC will recover to 2.4 million yen. On the 12th, there was a scene where the top price was temporarily heavy, but when the US CPI slowed down as expected by the market, BTC went up against the decline in US Treasury yields and played a higher level.

[Fig. 2: BTC vs Yen chart (1 hour)]Source: bitbank.cc

While the employment report surprised the unemployment rate by improving from 3.7% to 3.5%, wage growth, the source of inflation, slowed, leaving the market to focus on the latter. The CPI also fell for the sixth straight month on a year-on-year basis, declining by more than 0.5 percentage points for three consecutive months from October.

Next week, the US Producer Price Index (PPI) for December will be announced on the 18th, and the Bank of Japan (BOJ) will announce its policy-making meeting and quarterly outlook. Is it positive for the BTC market?

Markets are pricing in a reduction in interest rate hikes from 50 basis points (bp) to 25 basis points at the Federal Open Market Committee (FOMC) meeting in February due to the slowdown in the U.S. economy and inflation. On the 12th, he said a 25bp rate hike would be appropriate going forward.

Although the exit of the interest rate hike cycle is starting to appear and disappear, considering the steady recovery of US stocks including BTC, we should keep in mind the possibility that we will run out of buying before next month’s FOMC.

In addition, Chairman Powell this week did not strongly restrain such market expectations, but if US stocks continue to recover and go smoothly, it seems that there will be strong verbal intervention at the FOMC.

Technically, BTC vs. the US dollar is trending bullish due to the breakout of the consolidation and the three-way upturn in the Ichimoku Kinko Hyo.

Relation:bitbank_markets official website

Last report:Bitcoin Futures Market to Buy and Hold, Pay Attention to Price Movements After Index Release

This week’s bitcoin is technically bullish, such as three-way turnaround | bitbank analyst contribution Our Bitcoin News.