Virtual currency-related stocks rebound all at once, bitcoin whales tend to buy more

Macroeconomics and financial markets

In the US NY stock market on the 10th, the Dow closed at $186 (0.56%) higher than the previous day.

At a symposium hosted by the Swedish central bank, Chairman Powell emphasized the importance of the central bank’s independence and commitment to controlling inflation, and asked for their understanding, but refrained from mentioning monetary policy.

While there are speculations that inflation (high prices) has reached its peak, the CPI (U.S. Consumer Price Index) is due to be announced on the 12th, and market players will be watching closely. It is expected to slow down to +6.5% year-on-year for the first time since October 2009.

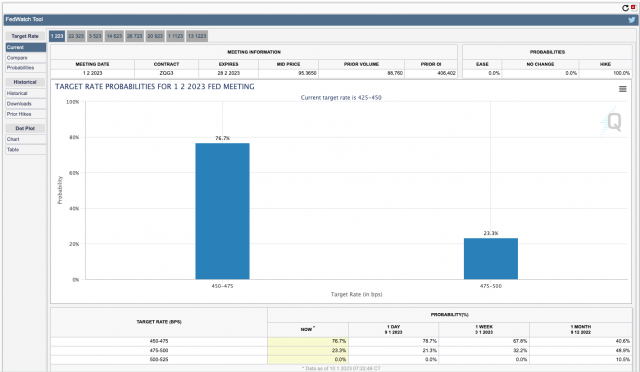

At the US Federal Open Market Committee (FOMC) meeting in February, it is pointed out that the Fed may reduce the range of rate hikes from 0.5% to 0.25%.

A 0.25-point rise is priced in at 76.7%, according to the Fed Watch Tool.

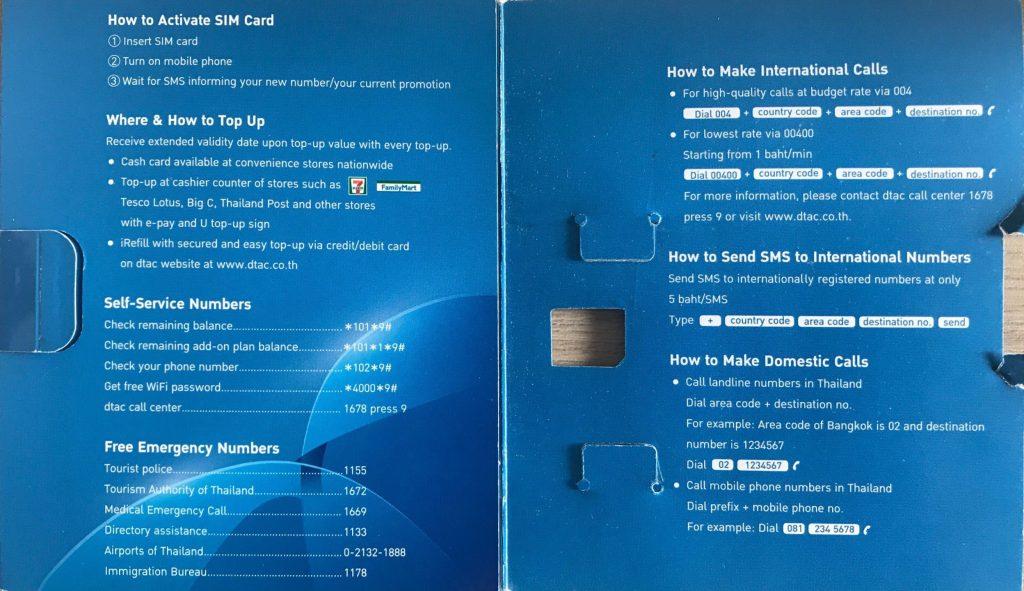

Fed Watch Tool

Relation:Financial market tankan on the morning of the 11th | Cryptocurrency-related stocks such as coinbase continue to rise sharply, US CPI announced tomorrow night

In response to the rebound in the crypto asset market such as Solana (SOL) and Ethereum (ETH) after 2023, stock prices such as Coinbase, the largest US cryptocurrency exchange, and Micro Strategy, which holds a large amount of Bitcoin, have rebounded.

Among major US mining companies, Marathon Digital rose 17.3% from the previous day and Riot rose 15.3% from the previous day.

In response to this, crypto-asset-related stocks such as Monex, a TSE-listed company that owns major exchange Coincheck, and Ceres, which owns Bitbank, have rebounded.

Coinbase’s stock price has fallen significantly, continuing to hit the lowest price since listing in 2022, and due to the sudden deterioration in business performance, the company announced new layoffs (temporary dismissals) to cut personnel costs. CEO Arm Strong reported on Oct.

He said that he had made a difficult decision, such as cutting operating costs by 1/4 compared to the previous term, but based on the FTX bankruptcy, he said, “Coinbase has sufficient capital, and the decline of strong competitors and the clarification of regulations will lead to (a strict regulatory level). compliance) will be beneficial for the company in the long run.”

Relation:Recommended securities account ranking for the stock market that can be used at a great price

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 0.2% from the previous day to $ 17,403.

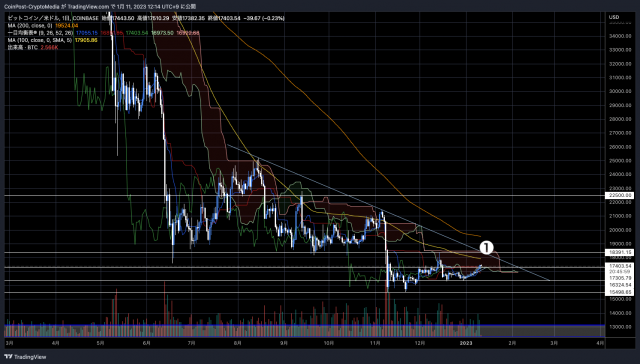

BTC/USD daily

With the US stock index rebounding and the alt market booming, the lower price will gradually rise.

If the 100-day moving average (100SMA) of $17,900 and the resistance line (upper resistance line) near $18,400 (①) where the Ichimoku Kinko Hyo overlaps the cloud top and the trend line, it will reach a psychological milestone of $19,500 or $20,000 at the 200MA. come into view.

In the immediate future, the CPI (US Consumer Price Index) announced at 22:30 on the 12th Japan time will be the touchstone. If the market falls short of market expectations, there may be a risk-on return, but if it significantly exceeds market expectations, there is a high possibility of throwing cold water on the optimistic mood.

According to data from on-chain aggregator Santiment, whale wallet addresses holding between 1,000 and 10,000 BTC have added a total of over 20,000 BTC over the past five days. The total holding amount of 4.57 million BTC in the same address group accounts for 23.7% of the total BTC supply.

#Bitcoin | Whales with 1,000 to 10,000 $BTC have been somewhat inactive. Still, these large addresses have added around 20,000 #BTC to their holdings since Jan. 5, shows data from @santimentfeed pic.twitter.com/Pmva4v0PKJ

—Ali (@ali_charts) January 10, 2023

Over the past three months, sentiment has been severely damaged by negative news following the FTX bankruptcy.

On the other hand, security researcher Jane Manchun Wong’s leaked information suggests that Twitter is continuing to develop its own currency “Coin”. There are also some positive developments.

According to Jane Manchun Wong, purchases of Twitter’s Coin could be made through online payment service Stripe.

In October last year, Elon Musk took over as CEO of Twitter after a huge acquisition of 6.4 trillion yen after many twists and turns. embarked on support.

Relation:Twitter to continue development of its own currency “Coin”

Google Cloud also announced support for Solana (SOL) in its Blockchain Node Engine (BNE) last November, before the FTX bankruptcy. He revealed that he joined the network as a validator for Solana Chain.

Relation:Google Cloud to introduce Solana’s node operation agency service

altcoin market

Although it is far from dispelling the uncertainty about the future, the alt market, which had been oversold, is showing signs of recovery. Ethereum (ETH), the second-largest market capitalization, rose 6.7% from the previous week.

The Ethereum (ETH) core development team has set an early February launch target for the public testnet of its first upgrade after The Merge, “Shanghai.” The target for the mainnet to go live is mid-March.

ETH staked on the ETH2.0 beacon chain is expected to be withdrawable via Shanghai.

Relation:Ethereum “Shanghai” public testnet to be held in February

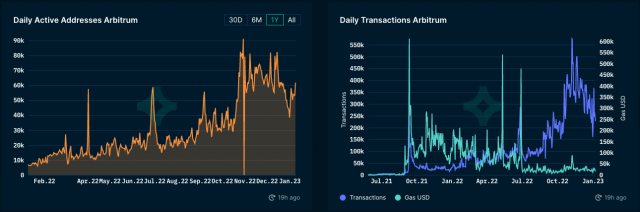

Ethereum Layer 2 rollups Arbitrum and Optimism have been trending upwards in trading volume over the past few months.

According to blockchain analytics platform Nansen, the number of transactions on Arbitrum has steadily increased since Nitro was upgraded last August.

Nansen

GM radio archive release

https://t.co/nr8dNhvmzM

— CoinPost Global (@CoinPost_Global) December 22, 2022

Special guests this time are Yat Siu, chairman of Animoka Brands, a major Web3 (decentralized web) company, and Benjamine Charbit of Darewise Entertainment. He talks about the current challenges of Web3 games and NFTs, Darewise’s first title “Life Beyond”, and the outlook for the industry.

Relation: To hold the 2nd “GM Radio”, guests are the chairman of Web3 major Animoka Brands

[Announcement]

CoinPost Hosts One of Asia’s Largest International ConferencesDate: July 25th and 26th, 2023

Venue: Tokyo International ForumPress release https://t.co/vvgzhfPOVb

[Specified]Accepting pre-whitelist registration that can be completed in 2 seconds https://t.co/bigJoFNBvh pic.twitter.com/5FfHvqKppB

— CoinPost-virtual currency information site-[app delivery](@coin_post) December 26, 2022

Click here for a list of market reports published in the past

Virtual currency-related stocks rebound all at once, bitcoin whales tend to buy more Our Bitcoin News.