What Will Bitcoin Miner Selling Pressure Look Like in 2023? Analyzed by Galaxy Digital

Headquarters in 2022

Galaxy Digital, a major US crypto asset (virtual currency) investment company, published an analysis report on the mining industry at the end of 2022 on the 25th.

Many miners with limited funding methods are said to be in survival (survival strategy) mode, and it is expected that this state will continue until the Bitcoin (BTC) half-life in 2024.

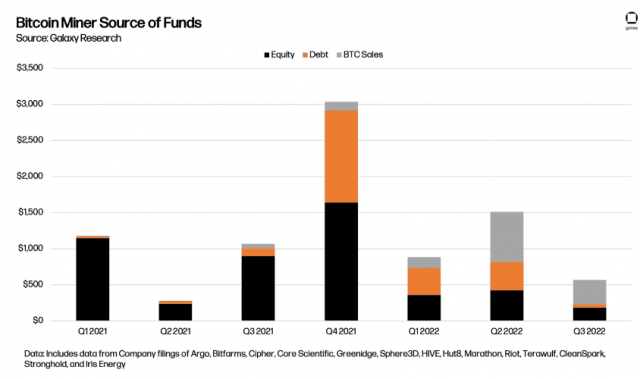

According to Galaxy Digital, since 2021, many miners have implemented a “wrong allocation strategy” that relies on loans to finance operating costs and capital investment costs. New issuance of Bitcoin mining equipment (ASIC)-backed loans in 2022 amounted to ¥66 billion ($510 million). Total issuance in 2021 was 25% higher, but they were all structured in the first half of the year.

Source: Galaxy Digital (same below)

In the third quarter of 2022, when the bear market progressed, the pace of new loans by lending companies slowed down, and miners were forced to sell the mined bitcoins that they had accumulated and kept, causing the BTC price to drop by 75% annually. It is said that it is in the background of

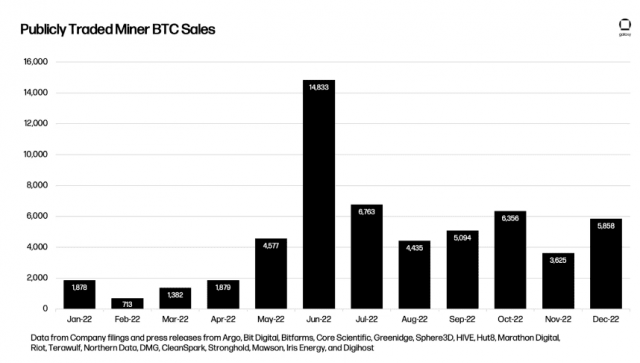

US-listed mining companies alone will sell approximately 58,773 BTC in 2022 (up from 3,500 BTC in 2021), according to public data. 36% of them occurred in Q2 2022.

Also, in 2022, these listed mining companies defaulted on 36 billion yen ($277 million) in loans, selling ASICs that generate more than 11.59 EH of hash power to moneylenders. In addition, a total of eight mining facilities (equivalent to 538 MW) were sold for ¥32.3 billion ($249.8 million).

This trend has caused the price of ASIC equipment to fall, leading to the aforementioned slowdown in the number of new loans.

Relation:Blockstream raises approximately 16 billion yen to expand mining facilities

Outlook for 2023

On the other hand, since the unprofitable miners’ treasury BTC sales activities have already been largely completed, Galaxy Digital has indicated that it is unlikely that the same size of BTC price decline will occur in 2023.

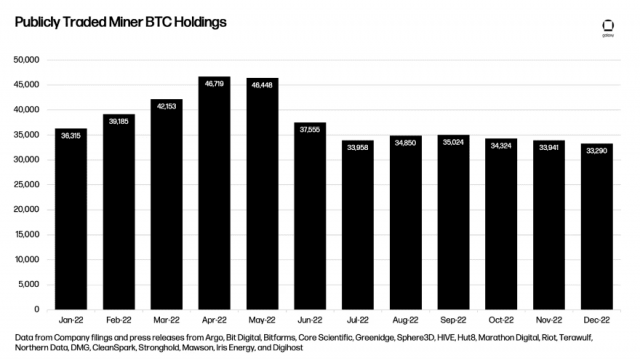

By the end of 2022, publicly traded mining companies will have 33,290 BTC in their Bitcoin holdings, but large BTC holding miners have already strengthened their balance sheets and there will be no urgent demand for cash.

However, access to the capital market is still declining for unlisted miners. The lifeline is 140 billion yen ($1.1 billion) of capital supplied to a “distressed fund” including a rescue fund set up by Jihan Wu of mining machine maker BitMain. Therefore, much of the BTC produced daily is likely to be sold immediately.

Relation:Bitmain Founder to Establish $300 Million Fund to Buy Bad Assets

In 30 days, miners on the BTC network have produced an average of 27,000 BTC. Galaxy Digital points out that even if all is sold to cover operational costs, it will not affect the price because physical BTC trading volume in the market as a whole is higher.

In fact, publicly traded mining companies, which account for about 28% share of the network, sold an average of 5,739 BTC per month over the past three months. Back-calculating, it is assumed that approximately 20,496 BTC are sold monthly across the network.

He also pointed out that two industrial structures of bitcoin mining operators are facing challenges and need to be improved in the future.

One is a service form of a lending company that accepts BTC mining machines as collateral. Borrowers want more flexibility, such as monthly payments that fluctuate depending on market conditions, and lenders need stronger covenants that allow them to liquidate their collateral more reliably in a bear market.

The other is a review of the pricing structure of mining hosting services, which have provided services at fixed costs. Two of the largest companies, Core Scientific and Compute North, have both filed for Chapter 11 bankruptcy protection after being hit by 41-year highs in electricity prices. .

Galaxy Digital also points to the potential for up to 5% annual turnover (APY) from Lightning Network channel operations as another means of improving the profitability of Bitcoin mining pools.

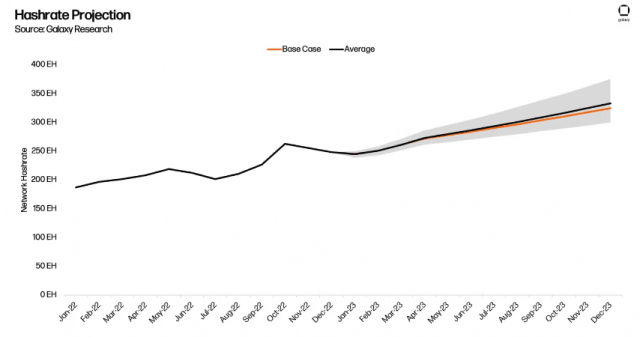

Considering this market environment, Galaxy Digital believes that miners will not be able to make large capital investments toward the halving in 2024. In 2023, we expect the network hash rate to remain at 325 EH/s, up 23%, and the Bitcoin price uptrend will be relatively flat.

Relation:Blockstream raises approximately 16 billion yen to expand mining facilities

What Will Bitcoin Miner Selling Pressure Look Like in 2023? Analyzed by Galaxy Digital Our Bitcoin News.